Ghana has saved more than GHS 2.6 billion and US$173 million from the cancellation of the upstream and mineral sector components of the Strategic Mobilisation Ghana Limited (SML) revenue assurance deal, according to the Office of the Special Prosecutor (OSP).

In an addendum to its earlier statement, the OSP explained that the savings are in addition to the GHS 1.2 billion already reported after the main SML contract was terminated.

The additional savings, it said, arose from avoiding payments tied to crude oil and gold export monitoring services that were never implemented.

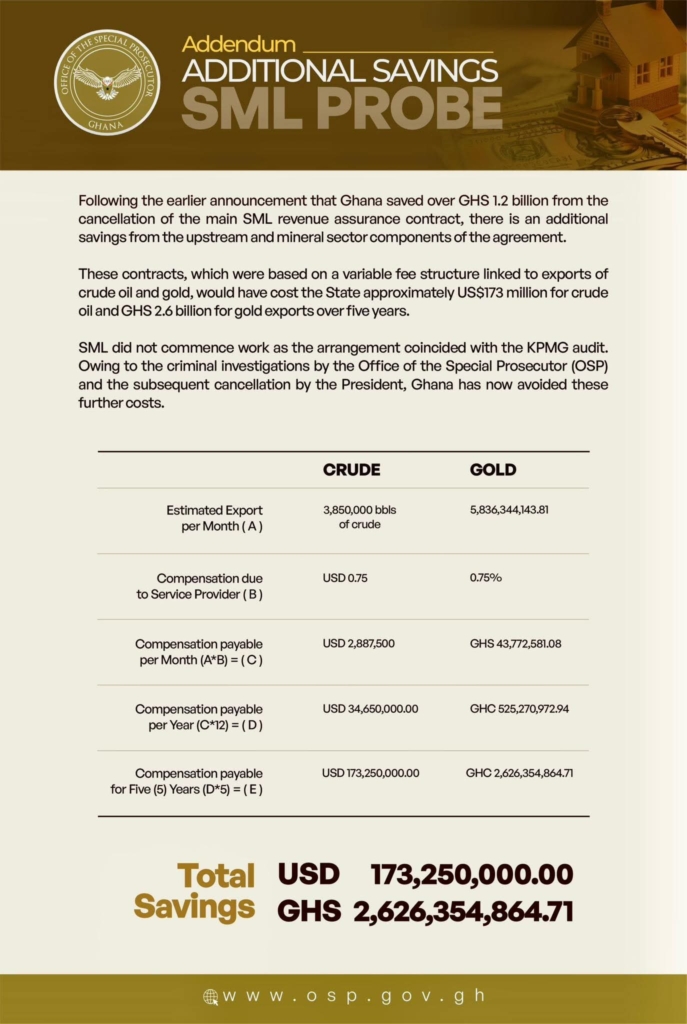

“These contracts, which were based on a variable fee structure linked to exports of crude oil and gold, would have cost the State approximately US$173 million for crude oil and GHS 2.6 billion for gold exports over five years,” the OSP noted in its statement.

According to the anti-graft office, SML did not commence operations in these sectors because the arrangement coincided with an ongoing KPMG audit and criminal investigations initiated by the OSP. Following these developments, President Akufo-Addo ordered the termination of the agreement earlier this year.

The OSP’s analysis estimates that Ghana exports about 3.85 million barrels of crude per month, with SML’s fee set at US$0.75 per barrel. That would have translated into about US$2.89 million monthly and US$34.65 million annually, amounting to US$173 million over five years.

Similarly, gold exports valued at over GHS 5.8 billion per month would have attracted a 0.75% service fee, costing the State GHS 43.7 million monthly and GHS 525 million annually.

The OSP said Ghana’s decision to halt the contracts saved the country from “further costs” while investigations continue into the processes leading to the award of the deal.

The SML probe has been one of the most closely watched anti-corruption investigations in recent months, with civil society groups and opposition politicians calling for transparency in how revenue assurance contracts are awarded in the extractive sector.