Nilex Suites has held its first open house as part of activities leading to the official launch of the luxury apartment development in Accra.

The pre-launch event took place at the Nilex Suites building at Osu on Wednesday, January 14, and brought together partners, financiers, and potential buyers.

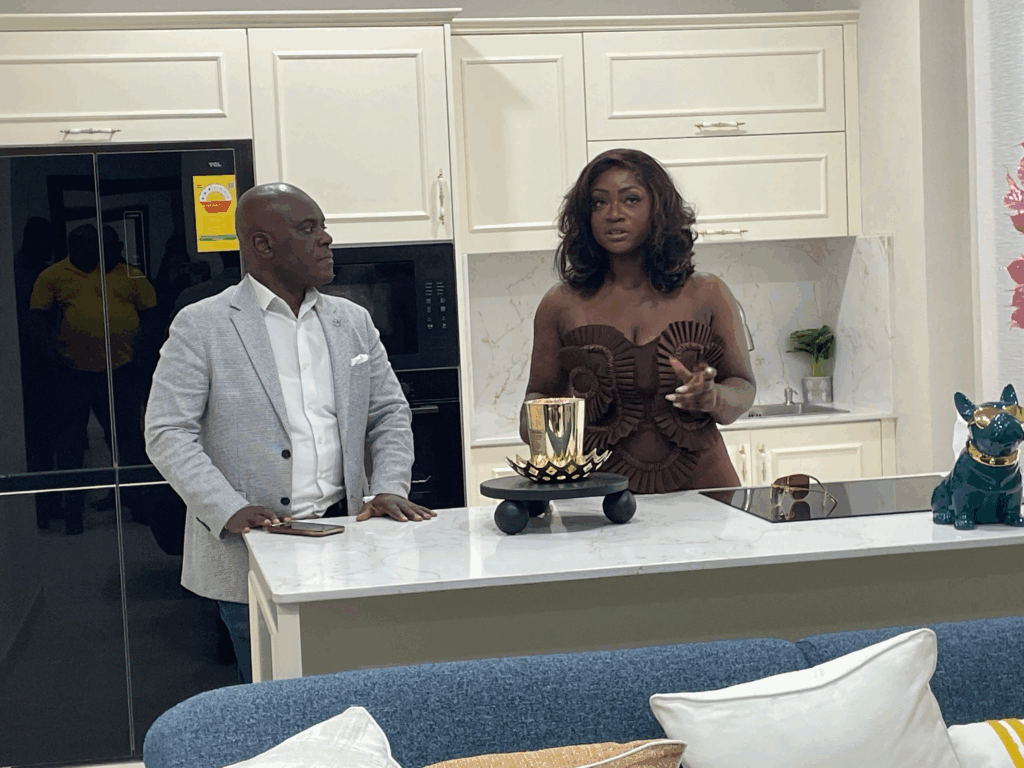

Speaking at the event, the Legal Director of Nilex Suites, Alexander Osei-Owusu, described the project as a major addition to Ghana’s real estate sector. “Nilex Suites is the biggest and tallest boy in the real estate industry. It is not yet fully grown.”

He explained that the open house was organised at the request of Nilex’s partners in London, with a clear focus on the Ghanaian diaspora.

“Today’s event, which is the pre-launch event, is actually organised at the request of our partners in London. This investment is actually looking at diasporans,” he said.

According to him, the project fits into what he described as “economic tourism”, targeting Ghanaians abroad and others with strong ties to Ghana.

“We are now moving towards what we call economic tourism. So we are targeting Ghanaians in the diaspora, or people in the diaspora who have some affinity to the motherland, to Ghana,” he said.

He said that many people who frequently visit Ghana during periods such as the December festivities often complain about the high cost of hotels.

“The major complaint has been the fact that hotel facilities are too expensive in Ghana,” he said, adding that short-term and long-term apartment rentals, including Airbnb-style arrangements, could help reduce costs through competition.

He also spoke about challenges faced by many Ghanaians abroad who build houses back home but do not live in them.

“We have a lot of stories where diasporas who have built a house in Ghana, they don’t live here. But when you go, somebody stays in your house, and you pay the person, you pay utilities,” he said.

He added that the idea of owning very large houses is no longer attractive. “In our time, it was pride to have six-bedroom or ten-bedroom houses. But now they ask the question, who needs ten bedrooms?” Now it is smart.”

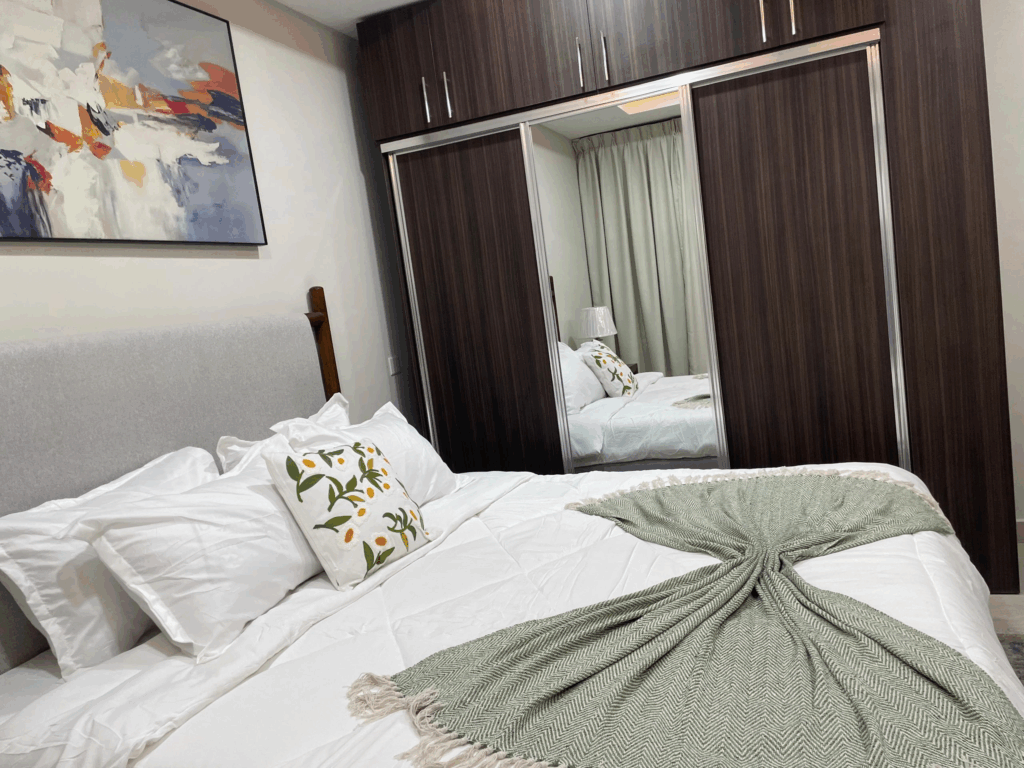

According to him, Nilex Suites is offering a simpler option. “Come and buy your apartment fully furnished. We give the largest apartment sizes, starting from 56 square metres. No developer gives you that.”

He explained that the apartments come with smart technology, allowing residents to control access, lighting, air conditioning, and appliances using their mobile phones.

“You don’t need the key to open your apartment. You just need your mobile phone. Everything is configured on your phone,” he said.

He added that even appliances such as microwaves can be programmed remotely so that meals are warm by the time residents arrive home.

The building, he said, is 19 storeys high, with two underground and two above-ground parking levels. “We have 72 units and 74 parking lots. Each apartment has a dedicated parking lot, and we don’t sell the parking lot separately,” he said.

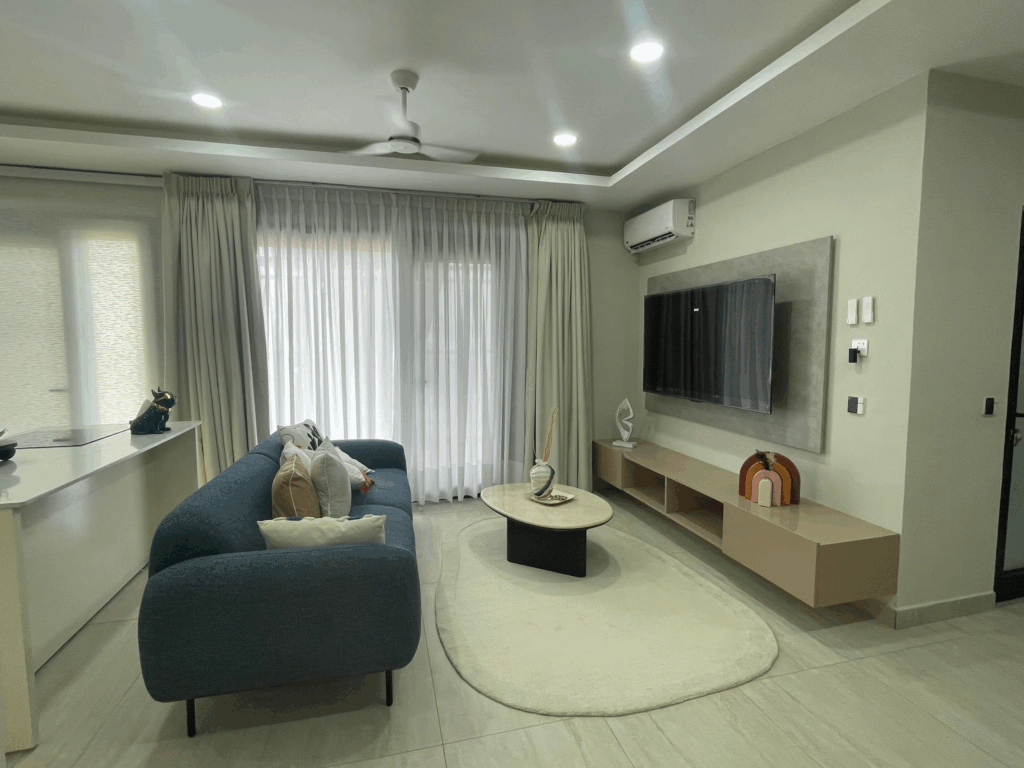

Facilities at Nilex Suites include a swimming pool, restaurant, bar, and central podium on the sixth floor, as well as a sky lounge that offers panoramic views of Accra. “That gives you the best view in Accra. On the lounge, you will see Accra 360,” he said.

Residents will also have access to a smart gym and a jogging track that runs through the building. “For those who want to go aerobic, we have the first jogging track along the entire bay. That will give you almost about three kilometres,” he said.

On financing, Lawyer Owusu said Nilex is working with mortgage banks and insurance companies to make purchases easier. “We are working with financiers and mortgage banks who can give you five years to 25 years to pay,” he said, adding that the entire property is fully insured.

He also highlighted energy efficiency and safety features. “We have three 750-kilowatt standby generators. More or less, the national grid is our backup. We are self-sufficient in terms of energy.”

He said the building uses fireproof cabling, smart lifts that consume minimal power, and a sewage treatment system that recycles wastewater through biodigesters.

One of the key selling points, he said, is the lease term. “Nilex is giving you 50 years. No developer gives you 50 years,” he said, explaining that buyers would not need to renegotiate leases for decades.

For diaspora buyers who are not always in Ghana, Nilex Suites plans to manage apartments as short-term rentals. “If you haven’t blocked a period that you are coming, we will run it for you as Airbnb. Even at 50 per cent occupancy, you are talking about a minimum of $1,500 to $2,000 rental income per month.”

He said this income could be enough to service a mortgage, making the investment more attractive than similar purchases abroad. “If you invest the same amount in London, it could take about 20 years to recover. But here, this property will give you between 8 and 10 years,” he said.

He added that construction is expected to be completed by mid-year, with full opening planned by the end of the second quarter.

Also speaking at the event was Ohemaa Oparebea from Opperknights, one of the partners on the project.

She said the development is open to both diaspora investors and residents in Ghana. “The whole objective is for us to bring not only people from London and the UK but also our funders in Ghana,” she said.

She explained that strong partnerships have been built with banks in Ghana to support mortgage financing. “Even though you live abroad, you can still be able to get financed here. All you have to do is reach out to us,” she said.

She acknowledged that many diaspora investors are used to structured financing abroad and often struggle with cash-heavy property transactions in Ghana.

She described the Osu location as ideal and said the project made her proud as a Ghanaian living in the UK. “We are Ghanaians working on this project. It makes me so proud,” she said.

A representative from Access Bank’s Mortgage team, Thelma Danquah, also spoke about mortgage options available to buyers. She said opening an account with the bank is simple.

“We just need the Ghana Card. For clients in the diaspora, we have soft copies of our forms on our website,” she said.

She explained that Access Bank offers diaspora mortgages, local home purchase mortgages and equity release options. “You can get up to 500,000 dollars or more, depending on your capacity,” she said.

She added that the bank considers income, credit history, and debt service ratio, and offers flexible repayment periods. “At Access, we do a maximum of 15 years, but depending on the conditions, we can tailor it to 20 years,” she said.

She noted that both salaried workers and self-employed individuals can qualify, provided they can prove their income. “As long as we can track your earnings, we can do that for you,” she said.