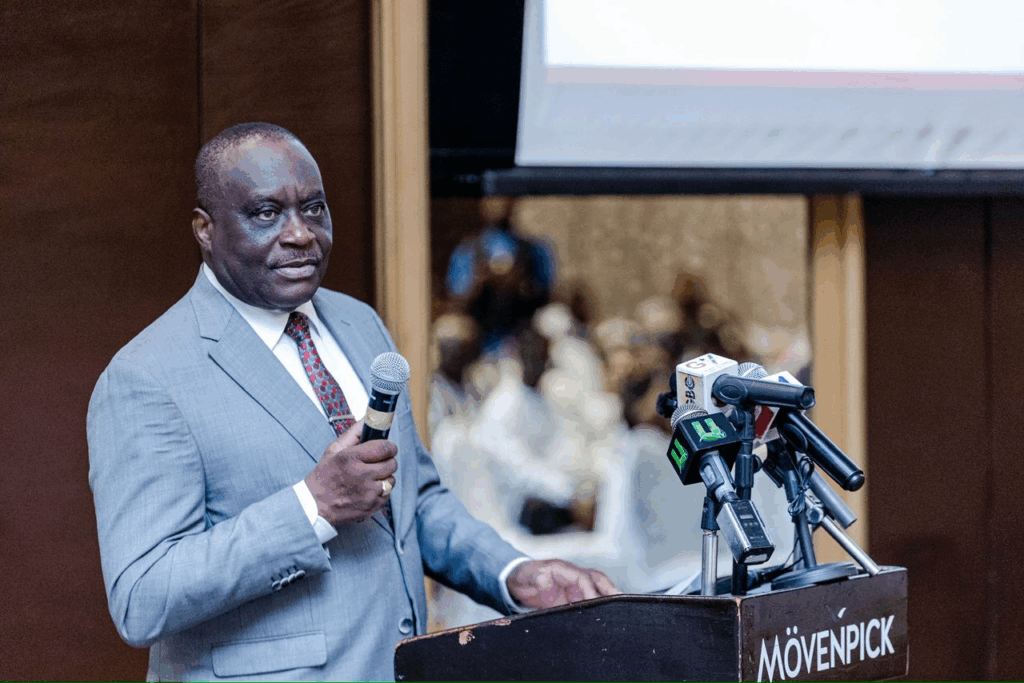

The Chairman of the Interim Advisory Council of the Insurance Retirees Forum of Ghana (IRFG), Mr Peter Osei-Duah, has advised young insurance professionals to listen, learn and lead with humility.

The former Managing Director of SIC Insurance PLC made this call during the launch of the Insurance Retirees Forum of Ghana (IFRG) at a ceremony held in Accra on Wednesday, February 18, 2026.

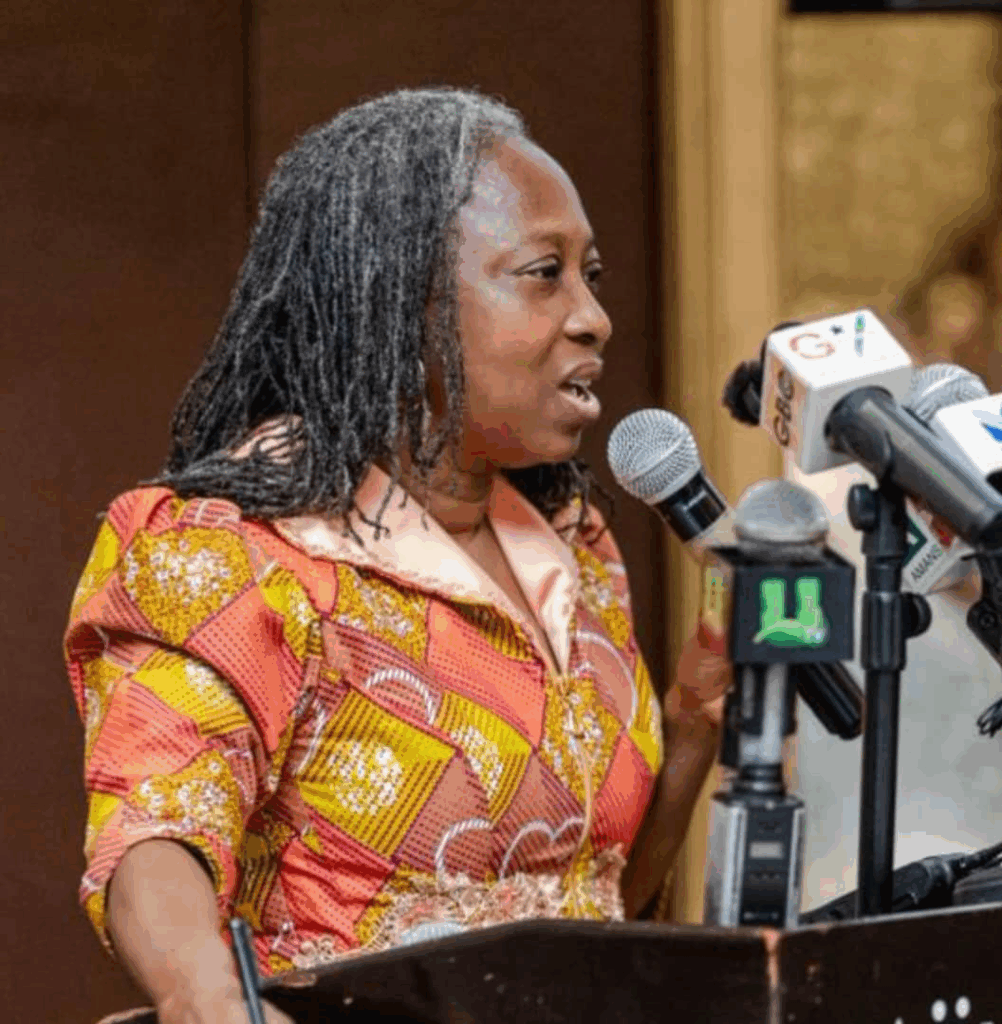

The Ghanaian insurance industry, led by Dr Abiba Zakariah, the Commissioner of Insurance (ag.), has taken a decisive step toward preserving institutional memory and strengthening professional standards with the objective to leverage the expertise and experience of veteran insurance practitioners.

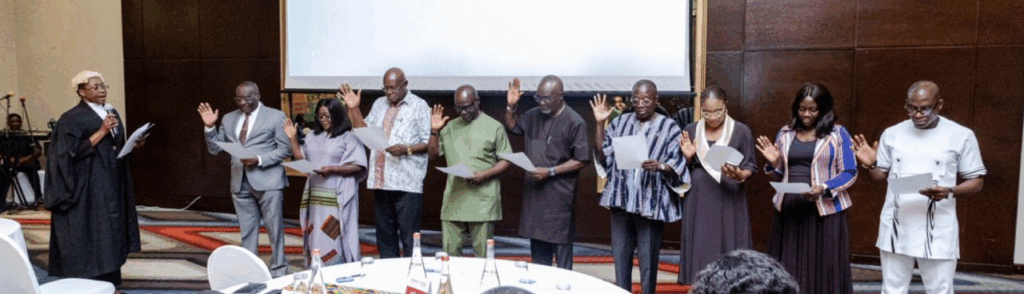

The Interim Advisory Council swearing-in ceremony was administered by Mrs Naa Shormeh Gyang (Esq).

During the inauguration, the Commissioner urged council members to uphold and reinforce the ethical and professional “golden rules” that defined their careers, while encouraging retirees to support the council in every possible way.

Members of the interim Advisory Council include retirees Mr Peter Osei-Duah as the Chairman, Mr Ivan Avereyireh, Mr Kofi Ampaw, Dr Francisca Karikari, Mr Bonahopas Arkhurst, and Mr Frank Oppong Yeboah. The rest representing various bodies in the insurance industry are Mrs Jonah (NIC), Mr EMrst Frimpong (Ghana Insurance University) and Mrs Adadey (CIIG).

In his acceptance remarks, Mr PMrr Osei-Duah described the launch as more than a ceremonial event, calling it “a statement of values.”

He emphemphasisedt an industry that forgets its builders risks losing its soul, stressing that the IRFG is not a charity orgaorganisation an investment in people, professionalism and the long-term stability of the insurance industry.

He commended the NIC, the Chartered Insurance Institute of Ghana (CIIG) and various other industry stakeholders for their vision and urged retirees to see their legacy as an ongoing and not as a destination.

He also challenged young professionals to demonstrate ethical standards and professionalism in their career as the insurance profession is a noble one that hinges on strong integrity.

In her keynote remarks, Dr ADra Zakariah, Commissioner of Insurance (ag.) exp,lained that the initiative aligns with the core developmental agenda of the National Insurance Commission (NIC) in strengthening and growing the insurance industry.

She noted that the gathering was convened to collectively find solutions to industry challenges, reinforce ethics and professionalism, as well as position retirees as mentors to the younger generation of insurance professionals.

She used the occasion to announce plans to establish a structured platform that would harness the knowledge and experience of retired practitioners, integrate them into strategic planning processes, and ensure their expertise continues to shape the future of the sector.

She further revealed plans to establish a fund dedicated to retirees, while also encouraging the renewal of old professional relationships and the building of new ones.

The forum brought together retired insurance professionals, regulators, industry executives, andstakeholders, among others.

The insurance professional body, the CIIG wwilldrive the initiative in collaboration with key industry bodies.

Mr Mrlomon Lartey, who is the President of the CIIG des, described the forum as “a long-overdue bridge between the rich heritage of our industry and its vibrant future.”

He acknowledged the leadership of the NIC and the CIIG for their efforts in making the inauguration a reality.

Mr Lartey intimated that the IRFG is strategically designed to ensure that retirement is not an exit from the industry, but an evolution of service.

He outlined key objectives of the forum, including mentorship and legacy transfer, technical advisory support for policy and standards review, welfare and wellness support for retirees, and the creation of a national professional networking platform across all segments of the insurance industry.

The launch of the Insurance Retirees Forum of Ghana marks a significant milestone in institutional continuity within the insurance sector, reinforcing a shared commitment to honohonouring past while securing a stronger, more ethical future for the industry.