The Country Managing Partner of Deloitte Ghana, Daniel Kwadwo Owusu, has stated that the importance of transparent and effective corporate governance disclosures cannot be overstated, as the regulatory landscape continues to evolve.

According to him, these disclosures are not merely a matter of compliance but are essential for building trust, demonstrating accountability, safeguarding the integrity of the financial system, and providing relevant information to enable investors to make informed decisions.

Speaking at the “Corporate Governance Disclosures: Bank of Ghana and Securities and Exchange Commission Requirement in Financial Statements”, Mr. Owusu said corporate governance is fundamentally about balancing the interests of a company’s many stakeholders—shareholders, employees, management, customers, suppliers, financiers, and the wider community.

“As the regulatory landscape continues to evolve, the importance of transparent and effective corporate governance disclosures cannot be overstated. These disclosures are not merely a matter of compliance; they are essential for building trust, demonstrating accountability, safeguarding the integrity of our financial system, and providing relevant information to enable our investors to make informed decisions”.

“Yet, we know that that meeting these requirements can be complex for a variety of reasons”, he stressed, adding, “Today, we have a unique opportunity to hear directly from regulators and our internal industry experts, who will share practical insights and best practices to help us navigate these challenges”.

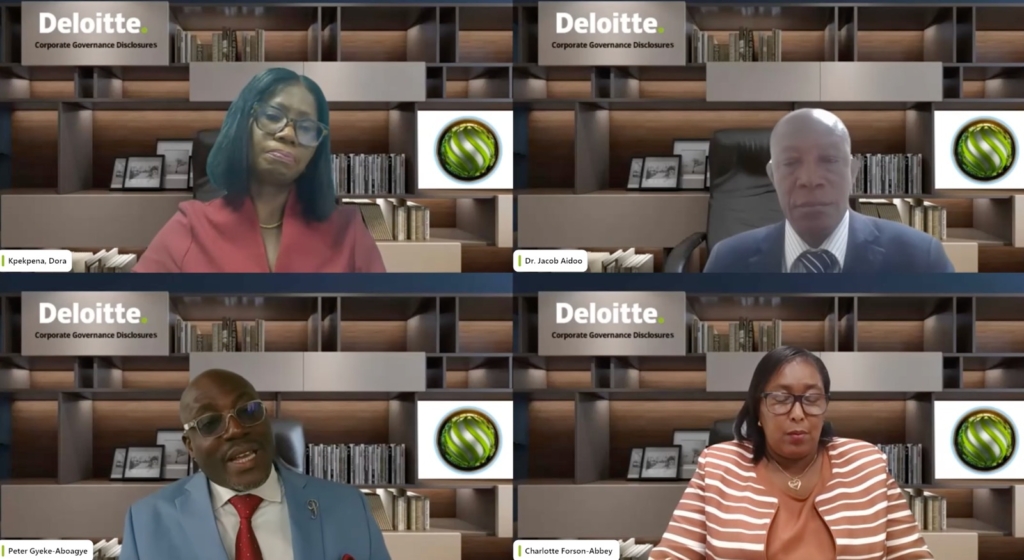

Speaking at the same event, the Divisional Head of the Banking Supervision Division of the Bank of Ghana, Peter Gyekye-Aboagye, said the central requirement of the corporate governance directive is to ensure that the board of directors annually satisfy the institutions’ performance and compliance in corporate governance.

“In doing that, there are three key areas that I looked at. The first is, are there any non-compliance issues involved, how did these issues come about, what are the remedial actions that have been put in place to ensure that these issues are solved going forward. Now these are things that we expect; we have a team of experts in the examination team within the banking supervision department. Once they go out to the field for examination, they look at all these things.

He added that the Central Bank ensures that the board members understand their responsibilities, highlighting that all these are reflected in the kind of minutes that we see”.

“Also, one of the things that I want to mention is that the Bank [BoG] has put in place a requirement in the corporate governance directive that the various board members must be certified”, he added.

The Director of Corporate Finance at the Securities and Exchange Commission, Dr. Jacob Aidoo, said his outfit expects every company to have an appropriate mix of experienced professionals with relevant skills and experience to man the institutions.

“We expect that you have not less than five members and not more than 13. And if these numbers are not adequate, you will then have to explain why you have gone below the three or gone above the 13. Whatever number you have on the board, the majority of them must be non-executive as opposed to executives”, he added.

The Deloitte Corporate Governance Disclosures Webinar was insightful as regulations governing corporate governance disclosures within the financial reporting continue to evolve.