Ghana is far below its tax potential in Sub-Saharan Africa – IMF

Ghana is far below its tax potential in the Sub-Saharan Africa region and the rest of the world, the International Monetary Fund has revealed in its report on Tax Expenditures in Sub-Saharan Africa.

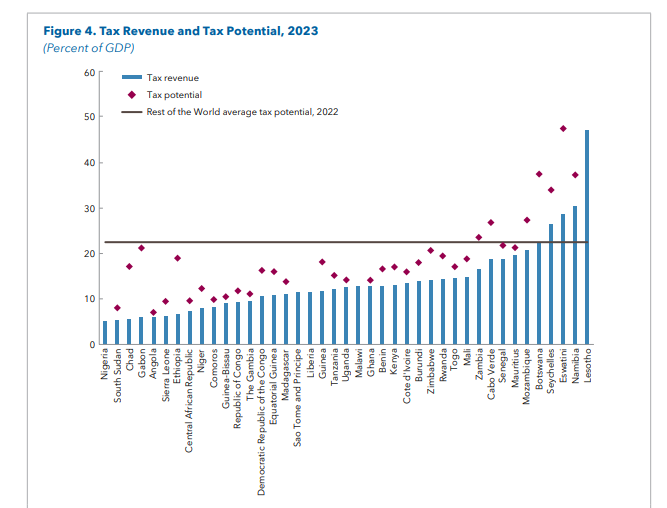

According to the Fund, the tax gap—the difference between actual collection and potential—exceeds 5 percentage points of Gross Domestic Product in about a third of sub-Saharan African countries,

“The cross-country heterogeneity in the estimated tax potential reflects differences in the level of economic development, the degree of informality, trade openness, and public sector effectiveness and corruption. Moreover, the region’s estimated tax potential—reflecting the upper bound of feasible revenue performance—is itself substantially lower than in other parts of the world, underscoring long-standing structural constraints”, it said.

“In this context, scaling back costly and often poorly targeted tax expenditures could contribute to narrowing the tax gap by strengthening revenue performance and improving the efficiency of the overall tax system”, it alluded.

Given the narrowing of external financing options and the growing urgency of building macroeconomic resilience and meeting development needs, the IMF said sub-Saharan African countries will need to look inward for under-explored areas of tax policy.

Trends in Revenue Mobilisation and Challenges

The IMF added that revenue mobilisation in sub-Saharan Africa has increased over time but has slowed in recent years.

The median total revenue-to-GDP ratio in sub-Saharan Africa rose from about 13% in 2000 to 16% in 2019, before falling back to about 14% in 2022 after the COVID-19 pandemic.

The Fund said the improvement was driven mostly by tax revenue. As of 2022, 18 countries in sub-Saharan Africa have a revenue-to-GDP ratio above 13%, the minimum level required for acceleration in growth and development.

Ghana’s tax-to-GDP presently stands 13%.