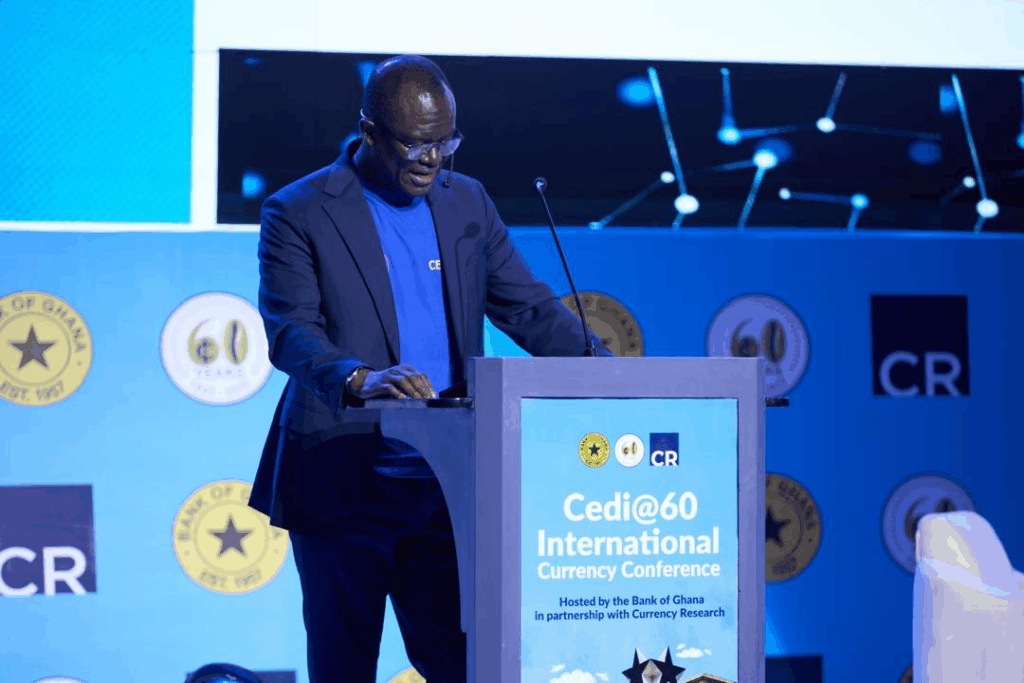

First Deputy Governor of the Bank of Ghana, Dr Zakari Mumuni, says digital payments have now become the central pillar of Ghana’s financial ecosystem.

He noted that digital payments are no longer peripheral, as households, MSMEs, and corporates now transact daily through channels that are faster, simpler, and increasingly interoperable.

Dr. Mumuni made the remarks while presenting a paper titled “The Digital Cedi – A Strategic Vision for Ghana’s Digital Currency” at the Cedi @60 International Currency Conference.

He explained that Ghana’s payment landscape has undergone an extraordinary transformation. In 2015, mobile money transactions accounted for just 3.4% of RTGS transaction value. By 2024, that figure had grown to almost half.

He emphasised that as digital payments expand, the need for a secure, sovereign, and interoperable digital currency becomes more urgent—hence the introduction of the e-Cedi.

According to him, the e-Cedi builds on existing progress to ensure that every Ghanaian, regardless of location or institution, can transact seamlessly within a trusted, central-bank-backed framework.

Dr Mumuni described the e-Cedi as the next frontier of Ghana’s digital journey, supporting a more progressive, resilient, and inclusive economy.

He added that it will also enhance financial inclusion by offering a more affordable digital payment alternative, particularly for underserved populations.

e-Cedi’s Potential to Aid Financial Inclusion

The First Deputy Governor highlighted the e-Cedi’s role in deepening financial inclusion, calling it a strategic step in strengthening Ghana’s financial system for the digital age.

He said the digital currency will support innovation and digital economy growth by providing a platform for fintechs and banks to develop new services and digital commerce solutions that enhance productivity.

Dr Mumuni also noted that the e-Cedi will improve monetary policy transmission, enabling better monitoring of money supply and faster responses to macroeconomic conditions.

He stressed that Ghana is uniquely positioned for successful e-Cedi adoption due to its strong digital foundation—robust national ID, a digital addressing system, and an interoperable payments ecosystem.

Progress in Ghana’s Payment System

Ghana’s payment ecosystem has undergone a remarkable transformation over the past two decades.

It began with the implementation of the Ghana Interbank Settlement System, one of the earliest RTGS systems in Sub-Saharan Africa, which enhanced liquidity in the banking industry while reducing credit and settlement risks.

The establishment of GhIPSS in 2007 advanced this progress further. Innovations such as the Automated Clearing House, Cheque Codeline Clearing system, the e-zwich biometric smartcard, and Gh-Link expanded efficiency and access to retail electronic payments.

These systems later provided the foundation for GhIPSS Instant Pay, a secure, real-time interbank platform that significantly improved the speed and convenience of payments.

The introduction of mobile money in 2009 marked another turning point. In 2018, mobile money interoperability enabled seamless transfers across networks and between wallets and bank accounts.

In 2020, the Bank of Ghana strengthened regulatory oversight with the creation of the FinTech and Innovation Office, ensuring orderly licensing and supervision of payment service providers and electronic money issuers, while safeguarding the integrity of the ecosystem.