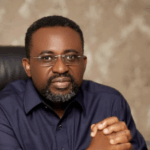

Governor of the Bank of Ghana (BoG), Dr Johnson Asiama, has revealed that Ghana will begin regulating cryptocurrency before the end of this year.

He says a new bill to govern virtual assets has already been drafted with support from the International Monetary Fund (IMF) and is now on its way to Parliament.

Speaking in Washington DC at the ongoing IMF/World Bank Spring Meetings, Dr Asiama said the move follows growing evidence of cryptocurrency use in the country, particularly in the remittance and informal exchange markets.

“Crypto is one area. We always knew that the phenomenon was there. But as you know, as some people say, crypto is like the air we breathe. It’s around us. It’s used around us,” he said.

“If you don’t engage in it, you don’t know it’s going on.”

According to the Governor, the central bank first noticed the scale of crypto activity when remittance inflows through the banking system suddenly declined after the appreciation of the cedi earlier this year.

He explained that many people in the diaspora were getting lower returns in local currency terms, prompting a shift to alternative digital channels.

“We saw the phenomenon at play when remittances suddenly reduced; apparently, the local currency had appreciated. And so therefore the diaspora that was sending the money, some of them, were getting lesser amounts in local currency terms,” he said.

“And so we saw a diversion by way of the channels of transmission. It was no longer going through the banks.”

Dr Asiama disclosed that investigations by the Bank of Ghana revealed that some of the dealers operating in the parallel foreign exchange market were using stablecoins and other virtual assets to facilitate cross-border transfers.

“What we observed was that some of the parallel market dealers through which these were coming through indicated to us that they were using stable coins and what have you,” he said.

“And so suddenly there was that active use of virtual assets, you know, to terminate even remittance inflows. So it confirmed our sense that it was an important area.”

The Governor said the central bank could no longer ignore the rapid spread of digital currency use in Ghana’s financial system and had decided to act decisively.

“We could not leave it just as that. We have to step up and be able to regulate and monitor these,” he said.

“We’ve done a lot of work in the past four months to put together the regulatory environment, and I must thank the IMF again. They’ve helped us to put together a new bill to regulate virtual assets.”

Dr Asiama confirmed that the new Virtual Assets Bill is currently being processed for parliamentary approval and should take effect by the end of December.

“That bill is on its way to Parliament as I speak, and so hopefully before the end of December, we should be able to regulate cryptos in Ghana,” he said.

The Governor, however, cautioned that legislation alone will not be enough. He said the central bank is building the necessary institutional capacity to monitor crypto-related flows and enforce compliance once the new law is passed.

“But I must say that passing a law is just one step in this process,” he said. “Going down the road, the ability to monitor those flows will be key. Therefore, we are developing the expertise and we are developing the manpower. We are putting together a new department that will help us to regulate that area.”

Dr Asiama reiterated that cryptocurrency and digital assets have become too significant to be ignored.

He emphasised that the Bank of Ghana is determined to establish proper oversight to protect the financial system and ensure transparency.

“Yes, it is an important area. We can no longer ignore it, and we are trying very hard to be able to regulate that as well,” he said.