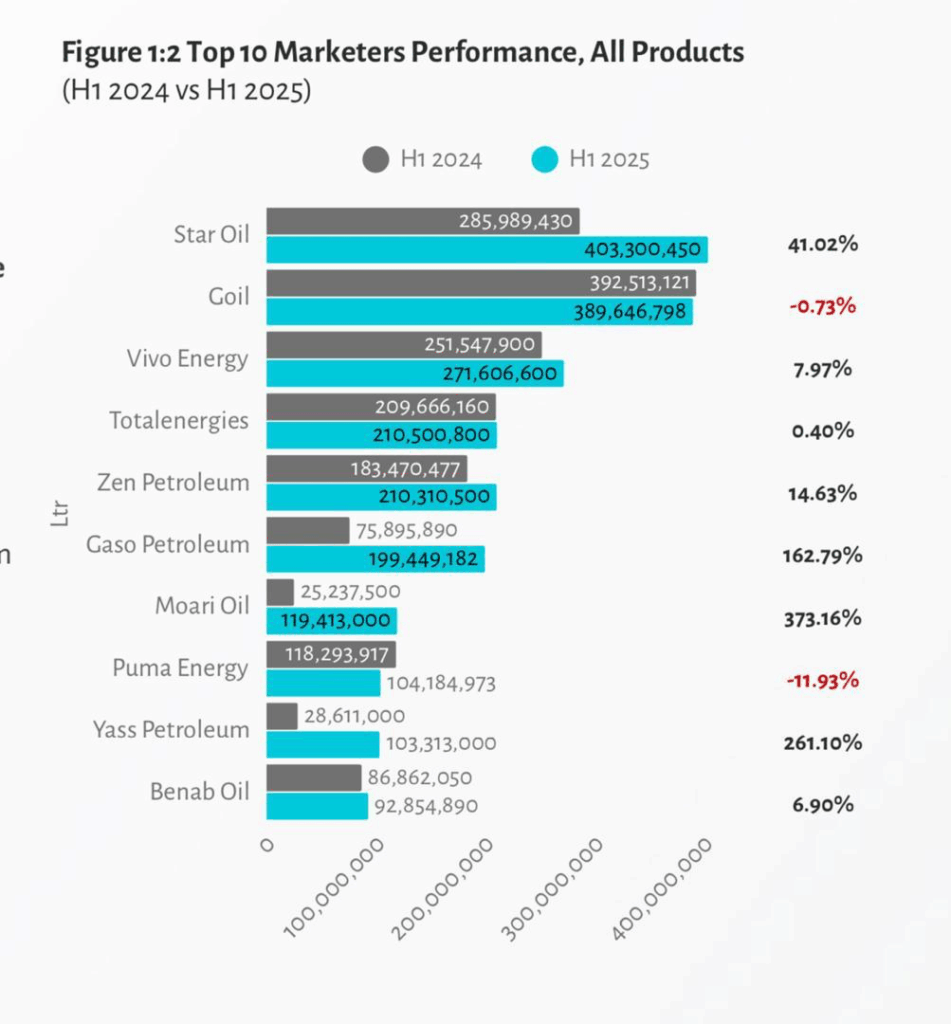

Star Oil has consolidated its position as the leader in Ghana’s Oil Marketing industry, according to new industry data for the first half of 2025.

The report shows that the company recorded a 41.02% increase in product volumes, reaching 403.3 million litres, thereby overtaking GOIL PLC in market share.

Its dominance was anchored in strong performances in gasoline and diesel sales.

Fastest Growth Rates Among Emerging Players

While Star Oil led in total volumes, the most dramatic growth came from Moari Oil (373.16%), Yass Petroleum (261.10%), and Gaso Petroleum (162.79%).

Gaso Petroleum’s gains were driven by its strong niche in industrial and maritime fuels, especially for power plants and mines.

In contrast, Puma Energy recorded an 11.93% decline in market share during the same period.

New entrants, Moari Oil and Yass Petroleum, each achieved impressive market share growth, with volume increases exceeding 70 million litres.

Performance of Established Players

Among the established brands, Zen Petroleum (14.63%) and Vivo Energy (7.97%) posted steady growth, while TotalEnergies (0.40%) remained largely flat.

Conversely, Puma Energy (-11.93%) saw a sharp drop, and GOIL (-0.73%) slipped slightly despite maintaining strong sales volumes.

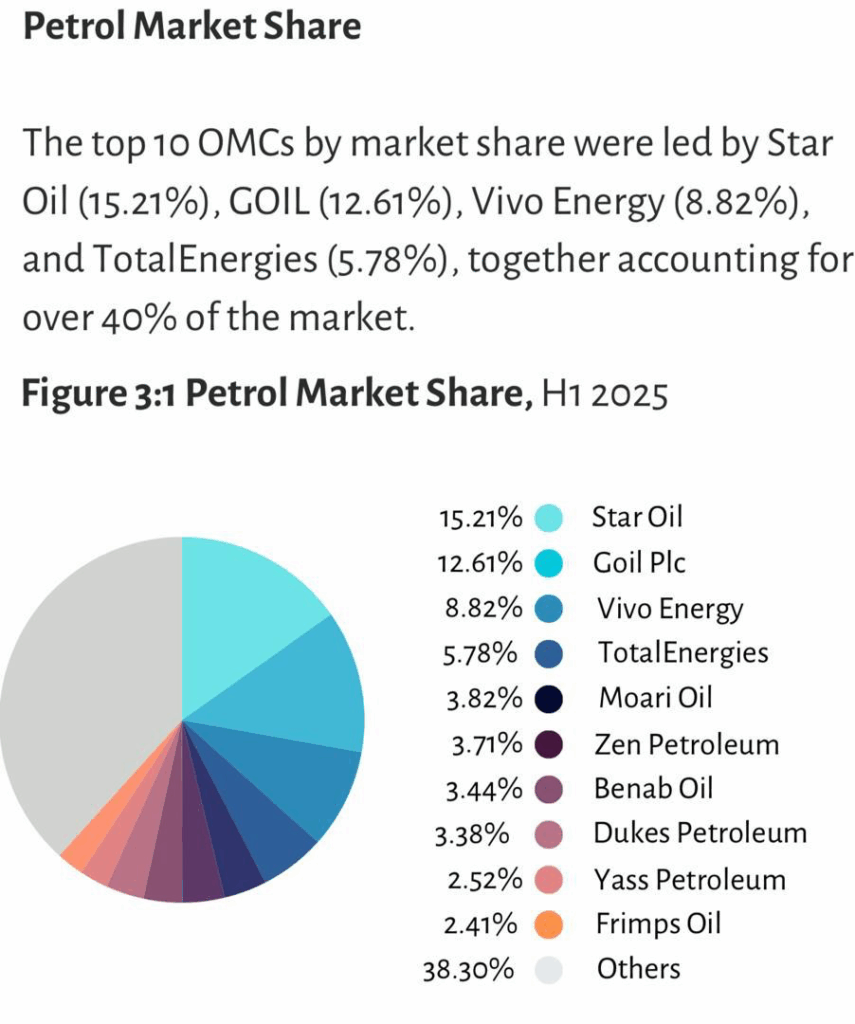

The top 10 OMCs by market share were led by:

- Star Oil – 15.21%

- GOIL – 12.61%

- Vivo Energy – 8.82%

- TotalEnergies – 5.78%

Together, these four accounted for over 40% of the total market share.

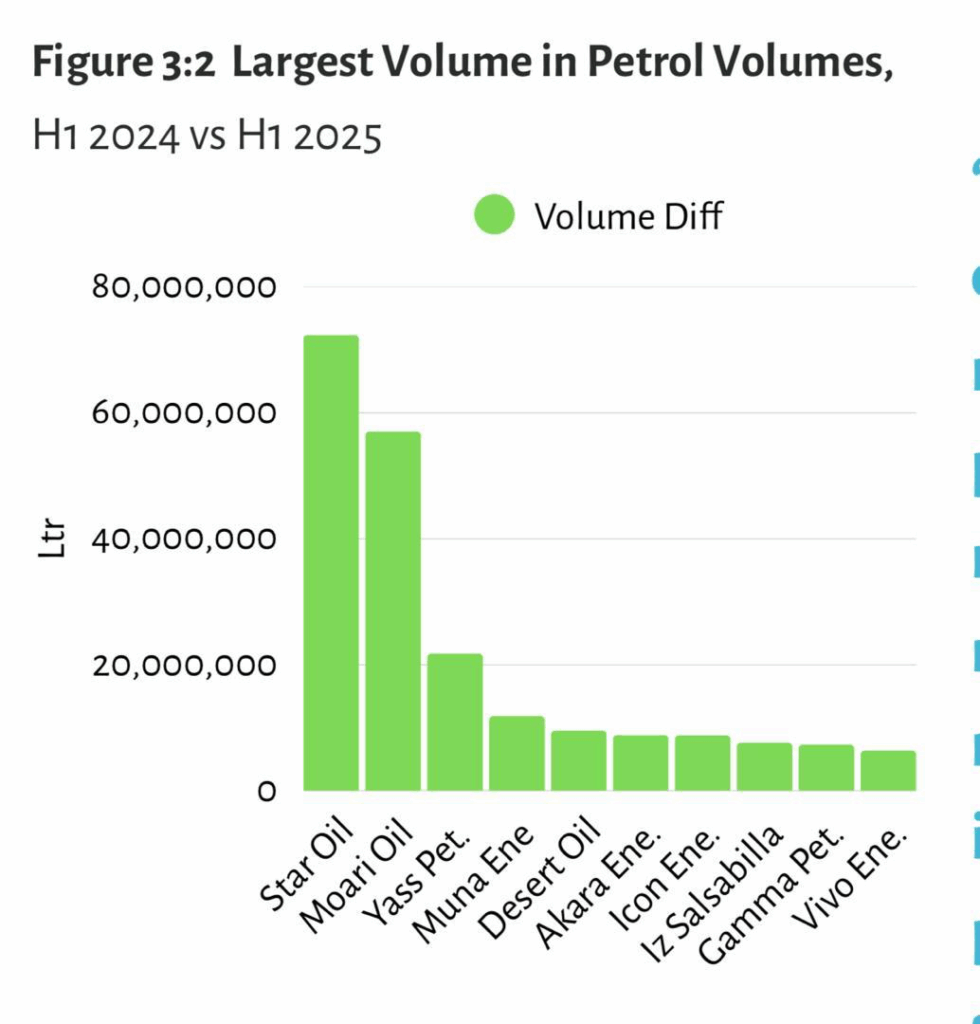

Between January–June 2024 and 2025, Star Oil (+72.36m litres) and Moari Oil (+57.04m litres) recorded the largest increases in petrol volumes, followed by Yass Petroleum (+21.81m litres), Muna Energy (+11.89m litres), and Desert Oil (+9.59m litres).

The first half of 2025 also saw extraordinary percentage growth among new entrants scaling from low 2024 volumes — Moari Oil (18,368.76%), Veros Petroleum (4,300.00%), Wabendso Energies (3,288.48%), and Life Energy (3,181.48%) emerged as standout gainers.

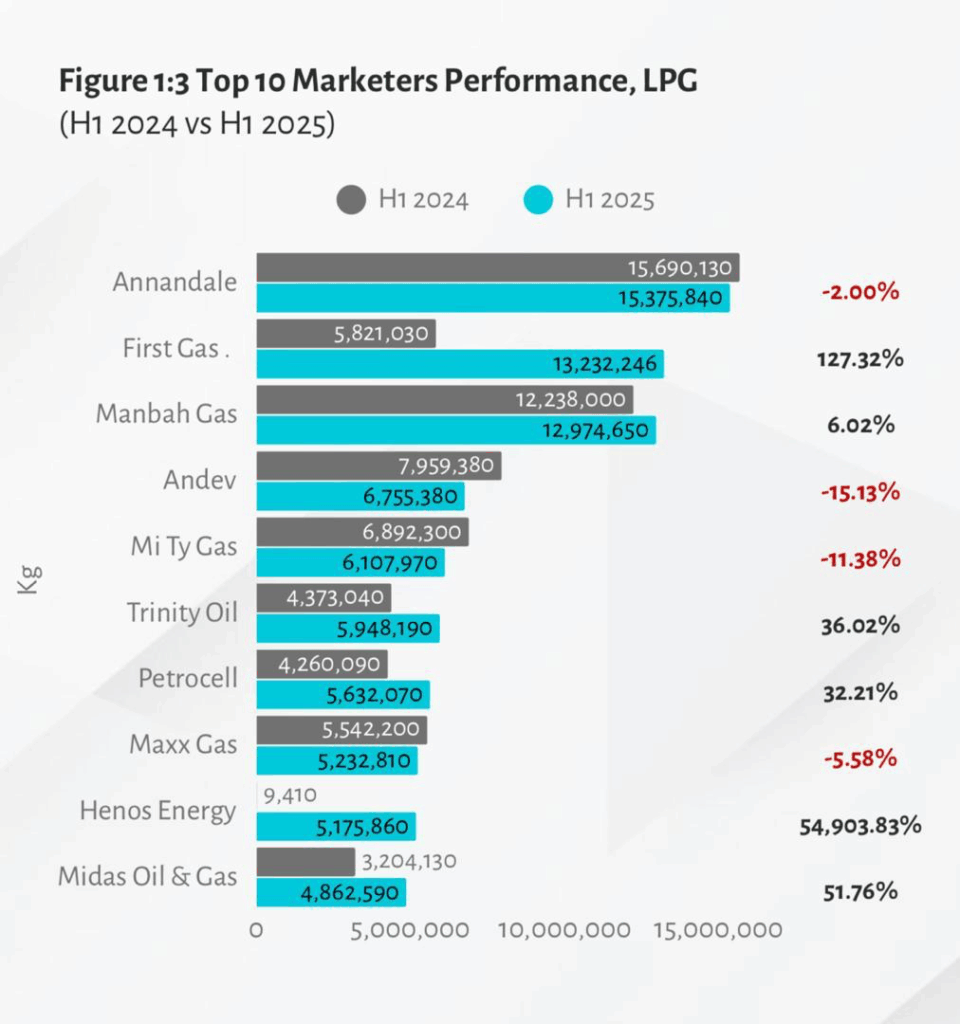

LPG Market Performance

In the LPG segment, Annandale retained the top position with 18.9% market share, despite a slight dip in volumes from the previous year.

First Gas rose sharply to 16.3%, taking second place, while Manbah Gas held third with 16.0%.

Mid-tier players Andev (8.3%), Mi Ty Gas (7.5%), and Trinity Oil (7.3%) recorded comparable volumes. Petrocell (6.9%) and Maxx Gas (6.4%) followed closely.

At the lower end of the top ten, Henos Energy (6.4%) achieved a strong breakthrough given its minimal volumes in 2024, while Midas Oil & Gas (6.0%) rounded out the list.

Bulk Oil Distribution Firms (BIDECs)

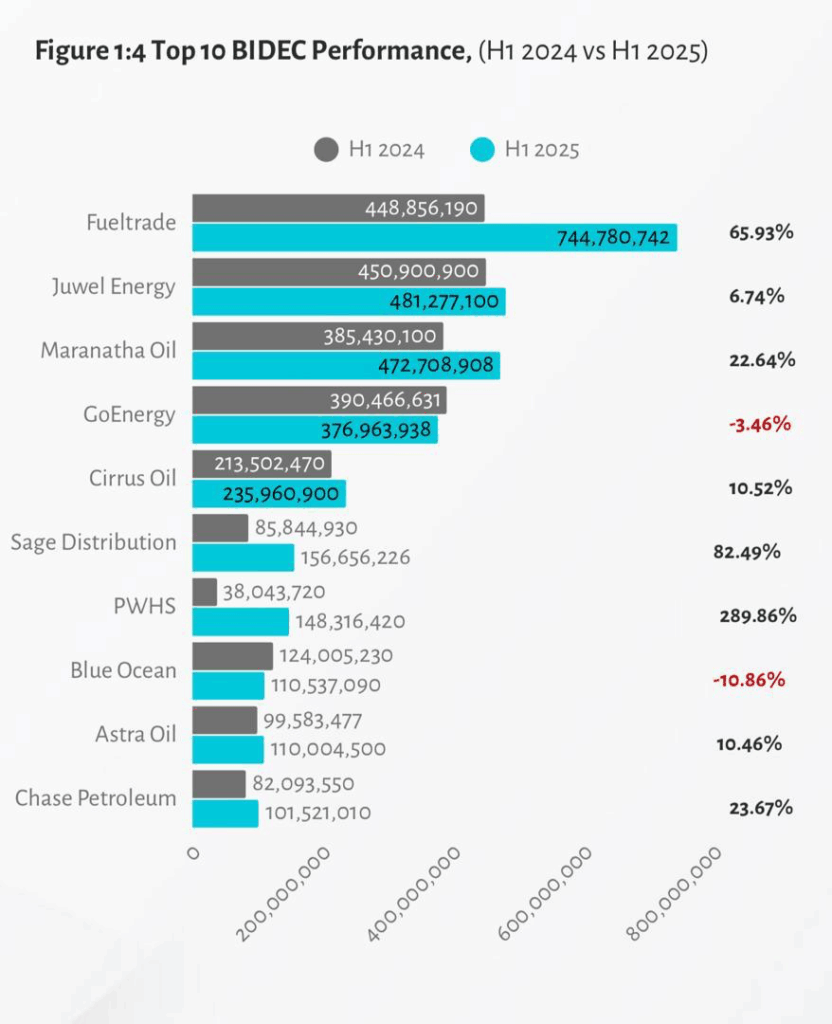

For the first half of 2025, Fuel Trade maintained its position as Ghana’s largest Bulk Import, Distribution and Export Company (BIDEC), expanding imports by 65.93% to 744.8 million litres.

Its strength lies in diversification — spanning gasoline, diesel, LPG, marine fuels, and power plant supply — making it the most dominant player in the sector.

The fastest growth rates were recorded by Sage Distribution (82.49%), driven by LPG imports, and PWHS (289.86%), which scaled rapidly across gasoline and ATK.

Maranatha Oil (22.64%), Chase Petroleum (23.67%), and Cirrus Oil (10.52%) posted steady gains, consolidating their mid-tier positions.

In contrast, GoEnergy (-3.46%) and Blue Ocean (-10.86%) saw declines in volume and market share — trends reflected in their affiliated OMCs, GOIL and Puma Energy, during the same period.

The evolving landscape also underscored niche strategies: Astra Oil focused on power plant fuels with over 115 million litres, while Sage Distribution established itself as the leading LPG-focused BIDEC.