Total consumption of petroleum products for the first half of 2025 has surged to 3.6 billion litres, marking a 17.65% increase compared to 3.07 billion litres recorded in the same period in 2024.

This is according to the 2025 Petroleum Analysis Report seen by JoyBusiness, which presents a detailed examination of Ghana’s petroleum supply and consumption trends from January to June 2025, alongside comparative data from 2024.

Volume Breakdown

Among the product categories, Fuel Oil (Power Plant) recorded the most dramatic year-on-year growth at 4,572.70%, followed by Marine Gasoil (Foreign) and Gasoline, which rose by 420.74% and 21.66% respectively.

Petrol and diesel accounted for the highest volume increases — petrol grew by 267.5 million litres, while diesel added 228 million litres.

In contrast, kerosene and residual fuel oil saw volume declines.

The data also highlights emerging trends, including rising demand for Marine Gasoil (Foreign) and Fuel Oil for power generation.

LPG consumption increased by 5.04%, driven by household and industrial adoption, with notable growth in the Upper West and Upper East regions.

However, the Northern Region recorded a sharp 49.53% decline in LPG consumption — a setback for national efforts to boost LPG penetration in the north.

Aviation Turbine Kerosene (ATK) usage dropped by 3.54%, from 133.2 million litres in H1 2024 to 128.5 million litres in H1 2025, reflecting reduced aviation activity, improved fuel efficiency among airlines, and operational challenges at some regional airports.

The Greater Accra Region accounted for nearly all ATK consumption but saw a 3.18% decline, from 132.2 million litres to 128.0 million litres.

The Kotoka International Airport remains the dominant hub for air travel and aviation fueling in Ghana.

Regional Consumption Patterns

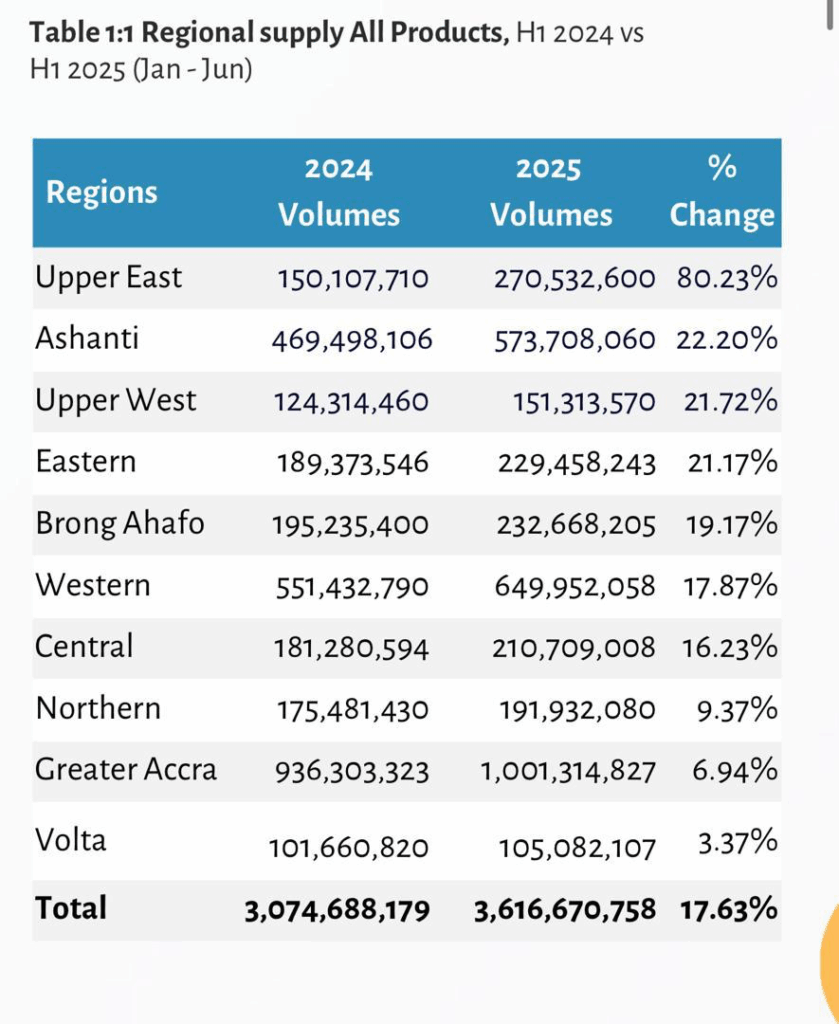

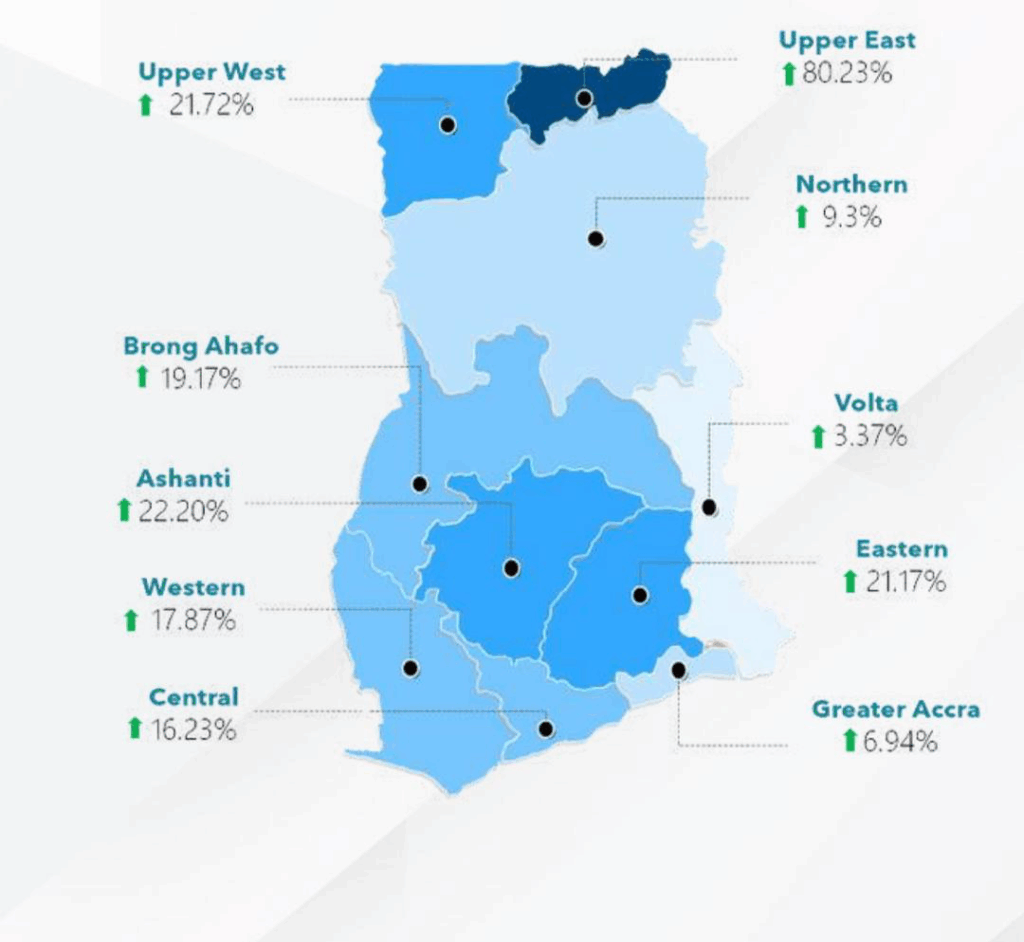

The report shows that in the first half of 2025, the Upper East Region recorded the highest growth in petroleum product consumption at 80.23%, followed by the Ashanti Region with a 22.20% increase.

The Upper West and Eastern regions also recorded substantial gains, with no region experiencing a decline — a contrast to the 3.85% decrease recorded in the Volta Region during the same period in 2024.

Petroleum supply grew across all regions, with total volumes increasing between H1 2024 and H1 2025.

- Upper East: 80.2%

- Ashanti: 22.2%

- Upper West: 21.7%

- Eastern: 21.2%

- Brong Ahafo: 19.2%

- Western: 17.9%

- Central: 16.2%

- Northern: 9.4%

- Greater Accra: 6.9%

- Volta: 3.4%

Overall, the data suggests a shift in growth momentum towards the northern and middle belt regions, even as Greater Accra and Western continue to anchor the highest absolute volumes.

Accra, the largest consumer at over 1.0 billion litres, grew by only 6.94%, indicating a saturated market. Petrol and diesel rose marginally by 4.57% and 3.55%, while kerosene plunged by 41.72% and Marine Gasoil (Local) declined by 24.52%.

In contrast, Fuel Oil for Power Plants skyrocketed by 4,572.7%, driven by surging demand for industrial power generation.