The Rotary Club of Ho, in a bid to bridge the digital gap between rural and urban communities, has sparked the interest of children in Kpogadzi in the Adaklu District of the Volta Region in robotics.

The initiative aimed to channel the minds of young learners towards science, technology, engineering, and mathematics (STEM), with a special focus on robotics.

The project, undertaken in partnership with LIFE-MAC Africa, formed part of the commemorative activities marking the 40th anniversary of the Rotary Club of Ho.

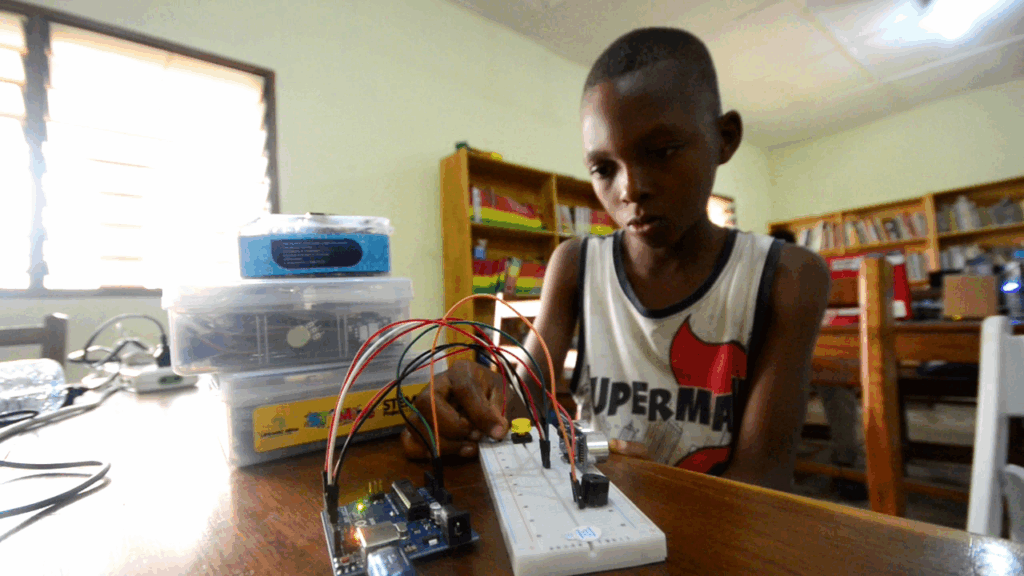

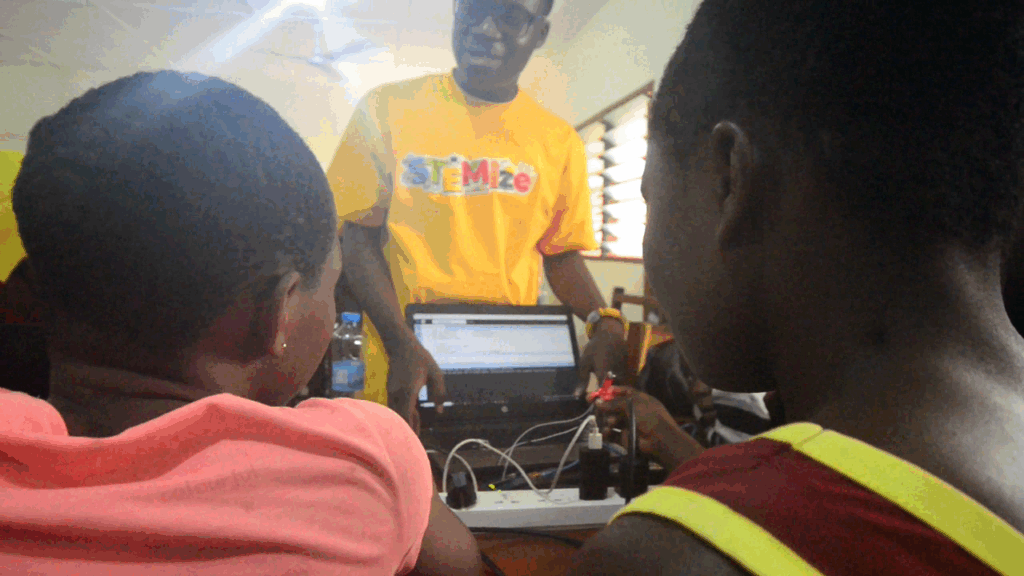

Hands-On STEM Training

Executive Director of LIFE-MAC Africa, Courage Tetteh, said the beneficiaries were taught to use basic materials to build sensors for checking humidity, water levels, and detecting objects. They were also guided to build streetlights and robots.

He explained that the programme used a practical, hands-on approach to capture the interest of the children, with the hope of influencing their educational paths and career aspirations.

Programs Manager of LIFE-MAC Africa, Benjamin Aklama, said the project would be sustained and extended to other communities to boost interest in STEM among African children.

“We will revisit this community and many others to whet the appetite of our younger siblings in STEM education because the world is STEM. The World Bank data suggests that a lot of African children do not show interest in STEM education, and we believe that it is because they don’t interface with it early enough. So that is the gap we are trying to bridge,” he said.

“At least we will come back six more times before this phase of the project will conclude, and I believe that will ground the children a little bit in STEM,” he added.

Rotary Club’s Wider Impact

Project Coordinator of the Rotary Club of Ho, Simon Fafali Awumey, said the STEM initiative was part of a broader approach to enhance the human resource capacity of the Kpogadzi community and improve their standard of living.

Under the economic empowerment component of the anniversary projects, interested community members were trained in bead-making, liquid soap production, and slippers decoration, among others.

“This is geared towards providing women with skills to help them become economically viable to earn some revenue to support their livelihoods,” Mr. Awumey noted.

A career mentorship programme was also organised to give young people insights into various career paths to guide their future choices.

As part of the anniversary activities, about 700 members of the Rotary, Lions, and Leo Clubs converged at Adaklu Kpogadzi to plant trees and paint a classroom block at the community’s basic school.

Earlier in the week, the Rotary Club of Ho commissioned a library, ICT lab, sanitation and water facilities for Precious Pearls Preparatory School, and a solar-powered mechanised water system for the Gbi Kledzo community in the Hohoe Municipality.

A billboard was also unveiled to reinforce the Club’s commitment to eradicating polio in its operational area, while members painted a classroom block at Ho Dome E.P. Basic School in Ho.

Celebrating 40 Years of Service

President of the Rotary Club of Ho, Maxwell Wallahs Affram, said all the anniversary projects were carefully selected to make a real difference in the lives of residents, particularly children and women.

“It is our hope and aim that we will touch lives as Rotary stands for ‘service above self,’ and our focus is to make an impact in the lives of the people we serve. Coming to Kpogadzi today has created a real impact in the lives of children in robotics, ICT, among others,” he said.