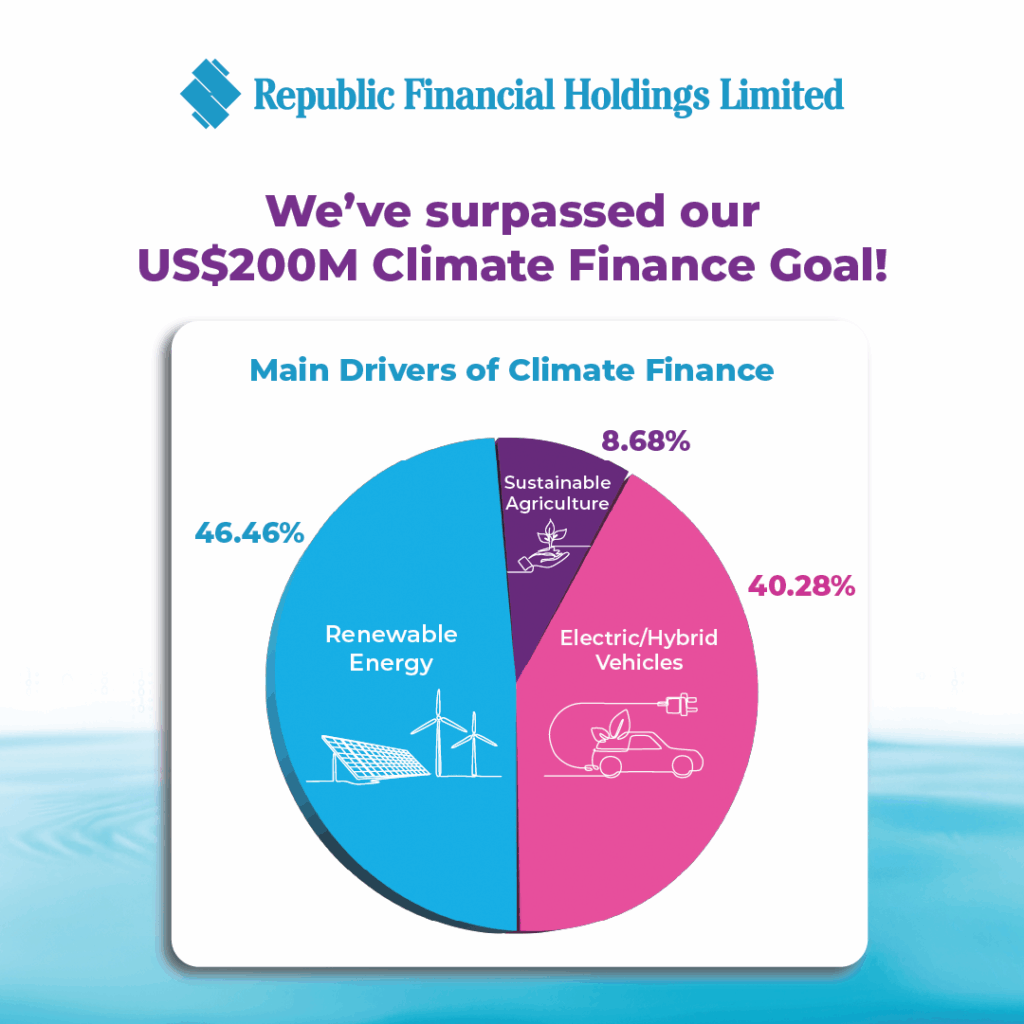

Republic Financial Holdings Limited (RFHL) has exceeded its US$200 million climate finance target, marking a major milestone in the Group’s sustainability drive and reinforcing its leadership in sustainable finance across the Caribbean and Africa.

The climate finance goal, set in 2021 under RFHL’s commitment to responsible banking and alignment with net-zero frameworks, was designed to mobilise lending and investment for climate-focused projects across the Group’s operating markets.

To date, RFHL has deployed approximately US$235.5 million in climate-centric financing, exceeding the original target by nearly 18 per cent, representing more than US$35.5 million above the benchmark.

Renewable energy has emerged as the largest beneficiary of the programme, accounting for 46.46 per cent of total climate lending and investment. This is followed closely by sustainable transport, which represents 40.28 per cent of total climate finance deployed.

The financing supports individuals and businesses implementing climate-adaptive and climate-resilient projects across multiple sectors, including renewable energy, energy efficiency, sustainable agriculture, sustainable transport, and other climate solutions aimed at promoting long-term environmental and economic sustainability.

Geographically, Trinidad and Tobago recorded the highest share of climate finance activity, accounting for 42.17 per cent of total deployments. Barbados followed with 25.36 per cent, while Guyana and Ghana contributed 12.17 per cent and 10.36 per cent, respectively.

These figures highlight growing demand for climate-focused financing across both RFHL’s Caribbean and African markets.

Commenting on the achievement, Group President and Chief Executive Officer of RFHL, Nigel Baptiste, said the milestone reflects increasing appetite for sustainable finance in the region and the critical role of financial institutions in driving climate resilience.

“Surpassing our US$200 million climate finance target demonstrates the growing appetite for sustainable finance within the region and underscores the critical role financial institutions can play in supporting the transition to more resilient, low-carbon economies,” he said.

He also praised staff across the Group for their dedication. “I want to acknowledge the dedication and collaboration of teams across our branches, units, and subsidiaries, whose collective efforts were instrumental in achieving this milestone. Their commitment continues to drive meaningful impact in climate resilience, sustainable development, and shared prosperity across the markets we serve,” Mr Baptiste added.

Sustaining the Momentum

Building on this progress, RFHL said it remains committed to advancing its broader sustainability agenda. The Group plans to continue mobilising finance for climate-related projects, expanding access to funding, and supporting climate adaptation, mitigation, and technical assistance, particularly in low-income and vulnerable communities.

The company reaffirmed its intention to play a leading role in supporting the transition to a more sustainable and inclusive low-carbon future across its operating markets.