The exit trails of November 2025 have found its way into the last month of the year, courtesy of the Dot Com Zambia PLC IPO on the Lusaka Securities Exchange (LuSE), running from November 17th to December 12th, 2025.[1] However, the offer period for the IPO successfully concluded on Friday, 5th December 2025, closing one week ahead of schedule as the offer was oversubscribed by 114 times. The offer saw significant retail participation with over 500 new shareholders, with 75% being Zambian investors.[2]

Triggering Singapore-based global Insurtech, Bolttech, to acquire Kenyan based digital insurance platform, mTek on December 3rd 2025[3], delivering a rare East African exit in a tough funding cycle, giving impetus to this essay. The paperless platform, serving 350,000+ customers and integrating with 45 insurers, gives Bolttech a ready-made entry into the region. Investors, including Verod-Kepple Africa Ventures and Founders Factory Africa, see returns after backing the startup through multiple rounds.

On December 8th, South Africa’s banking giant, Capitec, announced a $23M acquisition of Walletdoc to simplify online and in-app payments for it’s customers. This acquisition marks a significant milestone in Capitec’s strategy to offer leading secure payment acceptance to Capitec Business clients and simpler, more affordable e-commerce solutions to Capitec Personal Banking clients.[4] Capitec has also partnered with Stitch, one of South Africa’s largest payments fintech startups, to allow customers to automate recurring payments for services like Netflix, deliveries, bills using Variable Recurring Payments (VRP) – a smarter form of direct debit.[5] Earlier in the year, Stitch acquired Efficacy Payments to own the entire card-acquiring stack.[6]

South Africa’s leading banks, including Standard Bank, First National Bank, Nedbank, Capitec and ABSA have each developed strong investments as well as mergers and acquisitons capabilities targeting fintechs that are solving critical problems that deliver value to their customers. In some cases, the acquitions are strategic moves to minimise or eliminate disruption that these startups are championing which may pose a challenge to them in the long term.

The Johannesburg Stock Exchange (JSE) has strengthened its exchange-traded product offering with the listing of three new Exchange Traded Funds (ETFs), providing South African investors with broader access to global equities, multi-asset strategies and international property markets.[7]

Namibian private equity firm Eos Capital, through its Allegrow Fund, has exited its investment in Erongo Medical Group (EMG). Allegrow’s investment in EMG was executed as part of Eos Capital’s strategy to gain exposure to defensive, high-impact sectors with a particular focus on healthcare infrastructure and specialised medical services. This transaction represents Eos Capital’s first realised exit since inception.[8]

Algerian travel-tech startup Völz has raised 600m DZD (approximately $5m) in a new funding round led by private local investors. The transaction represents one of the largest disclosed rounds denominated in local currency for an Algerian startup. Perhaps more significantly for the wider ecosystem, the deal marks the first successful exit with a 3.35x return for the Algerian Startup Fund (ASF), the state-backed investment vehicle launched to kickstart the country’s venture capital market.[9]

Back in Kenya, Vodafone is taking the reins at Safaricom with a December 4th announcement of a $1.57 billion acquisition of a 15% government stake that lifts Vodafone Kenya’s total holding to 55%, giving it majority control for the first time since Safaricom’s 2008 IPO.[10] The deal also hands Kenya a rare cash windfall, with the government monetising future dividend rights for $309 million, while public investors keep a 25% slice. Safaricom stays listed, but Vodafone now calls the shots.

Industry analysts predict that this would most likely change the corporate culture of Safaricom in ways that would align it more with Vodafone – bringing it into the international corporate arena. For example, it would have to do away with the reputation of a corporate shack that has a litany of court cases and demads against it by startups and corporates for breach of contract and or theft of intellectual property. It would prefer to be seen as an enabler of the ecosystem in which it operates and not the stumbling block it has been for many years.

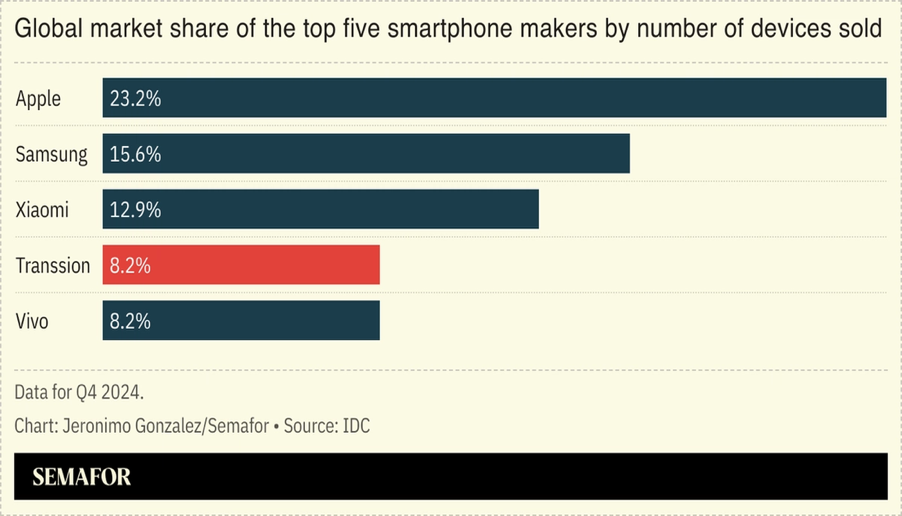

Transsion, the biggest seller of phones in Africa, could raise up to $1 billion via an IPO on the Hong Kong Stock Exchange, after filing paperwork this month.[11] The Shenzhen, China-based company, already valued at around $13 billion on the Shanghai Stock Exchange, is seeking the dual listing to gain access to Hong Kong’s capital markets and a wider pool of global-facing investors.[12] Transsion’s brands — Tecno, itel, and Infinix — have become ubiquitous across Africa over the last decade and the firm has been able to use its dominance on the continent to support its expansion into Asia and other markets to become the world’s fourth-largest phonemaker, according to the International Data Corporation. Last year, Transsion said it sold more than 200 million mobile phones in more than 100 countries. Longtime watchers of the company suggested it could use the new funds to expand into EV mobility products on the African continent.

Nigerian Exchange Limited (NGX), which provides a platform in Africa for raising capital and facilitates a secondary market for trading securities, has introduced Commercial Paper (CP) listings following approval from the Securities and Exchange Commission (SEC), marking another significant expansion of it’s product suite in a year defined by accelerated innovation. This develoment deepens Nigeria’s short-term debt market and reinforces NGX’s role as a versatile hub for capital formation.[13] Nigeria’s telecoms sector added ₦7.47 trillion ($5.16 billion) to GDP in Q3 2025, up 21.5% from last year, as rising data demand and a 50% tariff hike boosted revenue. MTN and Airtel together earned ₦5.16 trillion ($3.56 billion) in nine months. Telecoms may be small as a share of GDP (6.6%), but their impact is massive.[14] For example, Verve, a payment card scheme operared by Nigerian fintech company Interswitch, a Nigerian fintech company that seeks to launch an IPO, is expanding its contactless payment products and introducing tokenisation as it hits 100 million cards issued across Africa, 16 years after it was launched.[15]

Still in Nigeria, Aliko Dangote has announced plans to list 10% of his $20 billion refinery on the Nigerian Stock Exchange by 2026, marking a major step toward opening the megaproject to public investors. The move comes alongside discussions with regulators to allow dividends to be paid in US dollars. This unique structure, designed as a hedge against currency volatility, would enable investors to buy shares in naira but receive dollar payouts. Backed by an expected $6.4 billion in export earnings from petrochemicals and fertilizer, the dollar-dividend plan aims to provide reliable hard-currency returns. The announcement, made during the Dangote Vision 2030 unveiling in Lagos, also highlighted ambitious targets to grow group revenue to $100 billion and push market capitalization above $200 billion by the end of the decade.[16]

On December 19th, First Atlantic Bank, a 30-year-old indigenous financial institution listed on the Ghana Stock Exchange (GSE), becoming the first bank to go public in three years and the 12th banking stock on the bourse with the trading of it’s share commencing the same day. The lender completed its IPO with an oversubscription, signalling strong investor confidence ahead of its market debut. The offer, which opened on December 1 and closed on December 4, attracted strong participation from both institutional and retail investors, reinforcing the bank’s growing profile within Ghana’s financial sector and capital market.[17]

Societe Generales Des Travaux Du Maroc (SGTM)’s initial public offering closed on December 8 on the Cassablanca Stock Exchange after drawing record demand from investors. Nearly 173,000 investors subscribed to the offering, the highest number ever recorded on the market. Total demand reached about 171 billion dirhams, around 34 times the amount on offer, according to transaction data.[18]

Algeria is preparing for a modest but symbolic boost to its capital markets, with regulators expecting up to three new initial public offerings in 2026 as the country pushes to deepen its thinly traded stock exchange. Among the likely entrants is Ayrade, an IT firm seeking funding to expand its data center capacity, alongside potential listings from INSAG education group and an unnamed pharmaceutical company. The planned offerings reflect Algeria’s broader ambition to diversify an economy long anchored in oil and gas revenues. Momentum has been building since Banque de Développement Local raised $464 million in an IPO earlier this year, following the 2024 listing of Credit Populaire d’Algérie. Together, these moves signal a cautious reopening of Algeria’s public equity market.[19]

With these, it looks like the exit trail is heading into 2026 – seaons greetings.

[1] https://www.african-markets.com/en/stock-markets/luse/dot-com-zambia-launches-zmw-12-3m-ipo-on-the-lusaka-securities-exchange?mc_cid=5d2be0e5e4&mc_eid=40087f4350

[2] https://africancapitalmarketsnews.com/dot-com-zambia-ipo-closed-early-after-114x-oversubscription/?ref=frontiermarkets.co

[3] https://launchbaseafrica.com/2025/12/03/kenyan-insurtech-mtek-makes-rare-exit-to-singapore-unicorn-bolttech/

[4] https://techafricanews.com/2025/12/08/r400-million-deal-capitec-acquires-walletdoc-to-simplify-online-and-in-app-payments/?utm_source=substack&utm_medium=email

[5] https://techcabal.com/2025/12/04/capitec-vrp-lets-south-africans-make-recurring-payments-directly-from-bank/

[6] https://techcabal.com/2025/07/09/stitch-acquires-efficacy-payments/

[7] https://www.african-markets.com/en/stock-markets/jse/three-new-etfs-listed-on-the-jse-expanding-global-investment-opportunities

[8] https://www.africaprivateequitynews.com/p/namibias-eos-capital-achieves-first

[9] https://launchbaseafrica.com/2025/12/12/algerias-public-startup-fund-scores-first-exit-as-travel-tech-volz-raises-5m/

[10] https://techcabal.com/2025/12/04/1-57bn-share-sale-hands-vodafone-majority-control-of-safaricom/?utm_source=techsafari.beehiiv.com&utm_medium=newsletter&utm_campaign=this-week-in-african-tech&_bhlid=c553af054c3da9830fba2d60d961374b893ce688

[11] https://www.semafor.com/newsletter/12/12/2025/how-the-uae-and-us-are-approaching-africa?utm_source=newslettershare&utm_medium=africa&utm_campaign=flagshipnumbered4#f

[12] https://news.futunn.com/en/post/65722285/transsion-holdings-688036-the-king-of-mobile-phones-in-africa?level=4&data_ticket=1765575220558664&utm_source=semafor

[13] https://www.thisdaylive.com/2025/12/05/ngx-expands-market-offerings-with-introduction-of-commercial-paper-listings/

[14] https://techcabal.com/2025/12/02/phone-data-spending-telecoms-gdp-up-21/?utm_source=techsafari.beehiiv.com&utm_medium=newsletter&utm_campaign=this-week-in-african-tech&_bhlid=20546f98315d4096fc506d56463fc9fc4658ff16

[15] https://techcabal.com/2025/12/01/verve-hits-100-million-card-issuance/?utm_source=techsafari.beehiiv.com&utm_medium=newsletter&utm_campaign=this-week-in-african-tech&_bhlid=f1bb8755e36d7b87cb560216ad3ba244efe3acde

[16] https://nairametrics.com/2025/12/12/dangote-to-list-10-refinery-stake-on-ngx-pay-dividends-in-us-dollars/?mc_cid=15c77dbe1f&mc_eid=0af56d67ff

[17] https://businessday.ng/africa/article/ghana-stock-exchange-30-year-old-first-atlantic-bank-becomes-first-lender-to-list-in-three-years/

[18] https://www.dabafinance.com/en/news/sgtm-ipo-casablanca-record-subscription

[19] https://www.bloomberg.com/news/articles/2025-12-07/algeria-to-see-up-to-three-more-ipos-in-2026-regulator-says?srnd=homepage-africa&mc_cid=548d20d0ca&mc_eid=0af56d67ff&embedded-checkout=true